How Much Do Banks Make On Car Loans . as a starting point, consider the pros and cons of both car finance and bank loans. the most common way to profit off auto loans is a system known as dealer reserve. car loans let you borrow a lump sum of money to buy a car. Your monthly payment will depend on the amount of. Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. a car loan is paid back to the lender in monthly installments called loan payments. auto loans generally range from a few thousand dollars up to $100,000 or more. They typically come with repayment terms of 24 to 84 months, depending on the lender. Then, you'll make monthly payments to repay the loan with interest.

from www.moneycontrol.com

Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. Then, you'll make monthly payments to repay the loan with interest. the most common way to profit off auto loans is a system known as dealer reserve. as a starting point, consider the pros and cons of both car finance and bank loans. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. a car loan is paid back to the lender in monthly installments called loan payments. car loans let you borrow a lump sum of money to buy a car. auto loans generally range from a few thousand dollars up to $100,000 or more. They typically come with repayment terms of 24 to 84 months, depending on the lender. Your monthly payment will depend on the amount of.

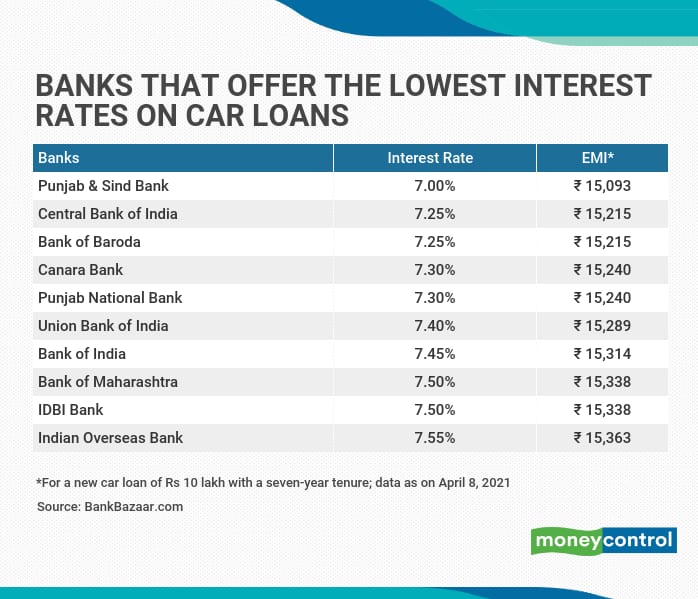

Punjab & Sind Bank, Central Bank of India offer the lowest rates on car

How Much Do Banks Make On Car Loans They typically come with repayment terms of 24 to 84 months, depending on the lender. as a starting point, consider the pros and cons of both car finance and bank loans. Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. the most common way to profit off auto loans is a system known as dealer reserve. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. They typically come with repayment terms of 24 to 84 months, depending on the lender. car loans let you borrow a lump sum of money to buy a car. a car loan is paid back to the lender in monthly installments called loan payments. auto loans generally range from a few thousand dollars up to $100,000 or more. Then, you'll make monthly payments to repay the loan with interest. Your monthly payment will depend on the amount of.

From fininfoblog.com

Car Loan Faceoff SBI Vs. HDFC Bank A Comprehensive Guide (Dec 2023) How Much Do Banks Make On Car Loans Your monthly payment will depend on the amount of. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. Then, you'll make monthly payments to repay the loan with interest. auto loans generally range from a few thousand dollars up to $100,000 or more. a car loan is paid. How Much Do Banks Make On Car Loans.

From www.loanknowledgeforall.com

Bank Of America Car Loan Easy Way To Getting Auto Loan ️ How Much Do Banks Make On Car Loans auto loans generally range from a few thousand dollars up to $100,000 or more. car loans let you borrow a lump sum of money to buy a car. They typically come with repayment terms of 24 to 84 months, depending on the lender. a car loan is paid back to the lender in monthly installments called loan. How Much Do Banks Make On Car Loans.

From habiletechnologies.com

Documents required for the most applied loans of India Habile How Much Do Banks Make On Car Loans auto loans generally range from a few thousand dollars up to $100,000 or more. Then, you'll make monthly payments to repay the loan with interest. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. car loans let you borrow a lump sum of money to buy a car.. How Much Do Banks Make On Car Loans.

From www.fastloanuk.co.uk

Guide to Car Loans, How Do Car Loans Work? How Much Do Banks Make On Car Loans Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. as a starting point, consider the pros and cons of both car finance and bank loans. a car loan is paid back to the lender in monthly installments called loan payments. Dealers have a “buy rate”. How Much Do Banks Make On Car Loans.

From firstbharatiya.com

Cheapest Car Loan Top 10 Banks Offering the Most Affordable Car Loan How Much Do Banks Make On Car Loans Your monthly payment will depend on the amount of. They typically come with repayment terms of 24 to 84 months, depending on the lender. as a starting point, consider the pros and cons of both car finance and bank loans. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will.. How Much Do Banks Make On Car Loans.

From www.youtube.com

Does TD Bank give car loans? YouTube How Much Do Banks Make On Car Loans Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. the most common way to profit off auto loans is a system known as dealer reserve. as a starting point, consider the pros and cons of both car finance and bank loans. They typically come with repayment terms of. How Much Do Banks Make On Car Loans.

From www.lihpao.com

Exploring Bank Loans for Older Cars Analyzing Financing Options How Much Do Banks Make On Car Loans car loans let you borrow a lump sum of money to buy a car. auto loans generally range from a few thousand dollars up to $100,000 or more. the most common way to profit off auto loans is a system known as dealer reserve. Dealers have a “buy rate” with each lender that represents the minimum rate. How Much Do Banks Make On Car Loans.

From bankbonus.com

Best Banks & Credit Unions for Car Loans 2024 How Much Do Banks Make On Car Loans auto loans generally range from a few thousand dollars up to $100,000 or more. car loans let you borrow a lump sum of money to buy a car. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. a car loan is paid back to the lender in. How Much Do Banks Make On Car Loans.

From citifmonline.com

Banks offering cheapest car loans in Ghana [Infographic] How Much Do Banks Make On Car Loans as a starting point, consider the pros and cons of both car finance and bank loans. Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. the most common way to profit off auto loans is a system known as dealer reserve. Then, you'll make monthly. How Much Do Banks Make On Car Loans.

From www.youtube.com

Car Loan Interest Rates Explained Car Loan Interest Rate of All Banks How Much Do Banks Make On Car Loans Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. Then, you'll make monthly payments to repay the loan with interest. as a starting point, consider the pros and cons of both car finance and bank loans. auto loans generally range from a few thousand dollars. How Much Do Banks Make On Car Loans.

From www.onescore.app

A Comprehensive Guide to Car Loans How Much Do Banks Make On Car Loans a car loan is paid back to the lender in monthly installments called loan payments. the most common way to profit off auto loans is a system known as dealer reserve. car loans let you borrow a lump sum of money to buy a car. Then, you'll make monthly payments to repay the loan with interest. . How Much Do Banks Make On Car Loans.

From www.pinterest.com

Check out average auto loan rates according to credit score RoadLoans How Much Do Banks Make On Car Loans as a starting point, consider the pros and cons of both car finance and bank loans. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. car loans let you borrow a lump sum of money to buy a car. auto loans generally range from a few thousand. How Much Do Banks Make On Car Loans.

From www.youtube.com

Apply Auto Loan On Chase Bank Online Chase Auto Loan 2021 YouTube How Much Do Banks Make On Car Loans auto loans generally range from a few thousand dollars up to $100,000 or more. the most common way to profit off auto loans is a system known as dealer reserve. Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. a car loan is paid. How Much Do Banks Make On Car Loans.

From loanofferbd.com

Mercantile Bank Car Loan » Loan Offer Bangladesh How Much Do Banks Make On Car Loans a car loan is paid back to the lender in monthly installments called loan payments. They typically come with repayment terms of 24 to 84 months, depending on the lender. as a starting point, consider the pros and cons of both car finance and bank loans. Then, you'll make monthly payments to repay the loan with interest. Dealers. How Much Do Banks Make On Car Loans.

From www.pinterest.com

Apply online for Best Car loans in India Compare car Loan interest How Much Do Banks Make On Car Loans a car loan is paid back to the lender in monthly installments called loan payments. Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under two. Then, you'll make monthly payments to repay the loan with interest. Dealers have a “buy rate” with each lender that represents the. How Much Do Banks Make On Car Loans.

From www.moneycontrol.com

Punjab & Sind Bank, Central Bank of India offer the lowest rates on car How Much Do Banks Make On Car Loans Your monthly payment will depend on the amount of. car loans let you borrow a lump sum of money to buy a car. auto loans generally range from a few thousand dollars up to $100,000 or more. Banks provide a wide range of services, but the most prevalent (and the most relevant to me and you) fall under. How Much Do Banks Make On Car Loans.

From www.bizzield.com

Financing Options For Car Loans Car Loans How Much Do Banks Make On Car Loans car loans let you borrow a lump sum of money to buy a car. They typically come with repayment terms of 24 to 84 months, depending on the lender. Then, you'll make monthly payments to repay the loan with interest. Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will.. How Much Do Banks Make On Car Loans.

From www.creditrepair.com

Average Auto Loan Rates Credit Repair How Much Do Banks Make On Car Loans Dealers have a “buy rate” with each lender that represents the minimum rate the bank or credit union will. Then, you'll make monthly payments to repay the loan with interest. car loans let you borrow a lump sum of money to buy a car. a car loan is paid back to the lender in monthly installments called loan. How Much Do Banks Make On Car Loans.